Power in Numbers

Saving Businesses Millions on Health Care

Proposal Would Allow Employers to Band Together to Purchase Coverage

The U.S. Department of Labor is moving ahead with plans that would allow small businesses and sole proprietors to band together to purchase group health insurance plans.

The DOL aims to permit these small business health plans – also known as “association health plans” – to skirt the regulatory requirements of some states and the Affordable Care Act.

Under the proposal, small businesses and sole proprietors would have more freedom to band together to provide affordable, quality health insurance for employees.

This would be done by creating an association plan that would help them secure competitive premium rates through economies of scale. An association with a few thousand members would have more bargaining power than an individual small employer and open the door to a wider array of insurance options, according to the DOL.

The proposal essentially modifies the definition of “employer” under the Employee Retirement Income Security Act regarding what type of organizations can sponsor group health plans. It adds “association” to that definition, so that such associations could sponsor group health coverage. In other words, the proposal would allow an association to be formed for the purpose of offering a health plan.

The proposal, experts say, could be expanded to allow employers throughout the country to form an association if they can pass a commonality of interest test, such as:

Additionally, the proposed regulations would let sole proprietors join small business health plans to provide coverage for themselves as well as for their spouses and children.

The proposed rules would allow these plans to skirt many of the provisions that the ACA requires of small plans, including that they include “essential health benefits.” Currently, large employer group plans and self-funded plans are not required to comply with the essential benefit requirements.

The DOL was careful to note that the proposal would bar health plans from rejecting coverage to anyone with pre-existing conditions and would include nondiscrimination provisions under the Health Insurance Portability and Accountability Act and the ACA.

About the Speaker

John W. Sbrocco

As a leading healthcare risk manager and benefits consultant, John W. Sbrocco, CSFS has built a reputation based on transparency and results. Most notably, John’s clients often point to his ability to implement complex risk management solutions in a way that’s digestible, actionable and more importantly, measurable.

These core values along with John’s skill set fueled the growth of his companies, Questige Consulting and Achieve Health Alliance. Despite the success of his companies, John’s ultimate goal is to change the unsustainable way that businesses currently approach health care.

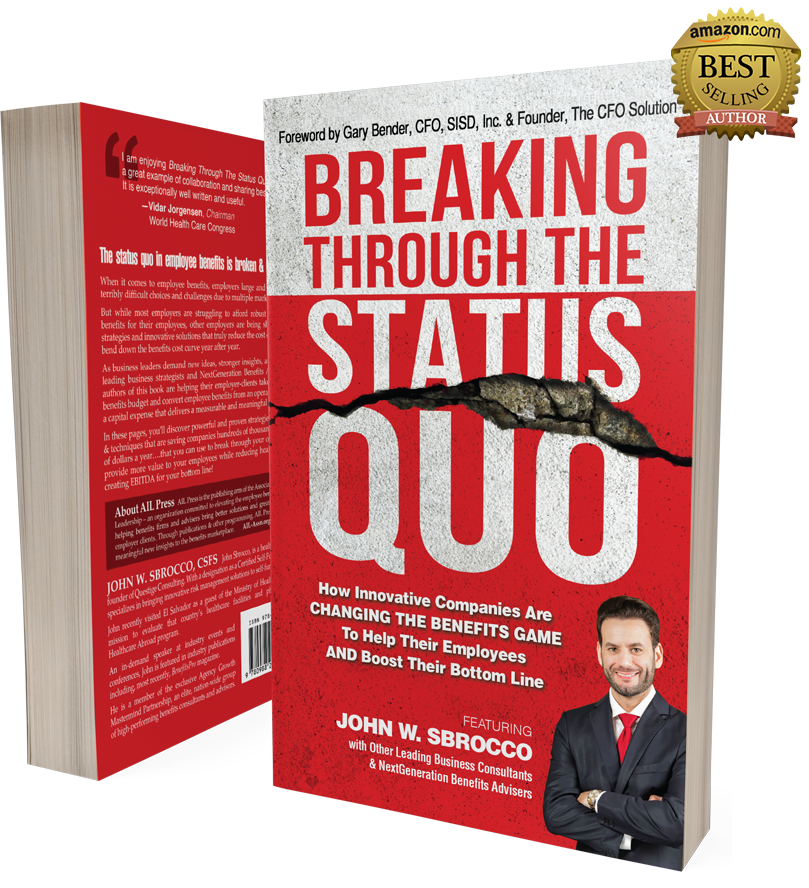

Best Selling Author

Breaking through the Status Quo

As an author, John puts many of his most effective practices onto paper. Not afraid to give away trade secrets, John feels sharing his innovative strategies will ultimately aid in his cause of Breaking Through the Status Quo of the current state of employee benefits.

John’s biggest goal is to put the consumerism back into insurance by showing employers that they have alternative options to choose from rather than just continuing to accept drastic renewal increases for lower quality insurance.